The credit card number isn’t just a random string of digits. Each digit holds significance. Let’s delve into it and understand what these digits want to say. Additionally, we’ll also explore why online shopping websites like Amazon, Flipkart, Paytm, etc., do not store our card’s CVV number. Finally, I’ll provide some tips that might help you manage your credit card.

Understand the Credit Card Number

Let’s start with the 16-digit credit card number. This number is called the Primary Account Number. It’s formed by combining three sets of different numbers, which denotes 3 different things.

The first six or eight digits don’t really have a direct connection to you or your account. It’s more of an identifier number that denotes the institution or bank that issued the card. This is known as the Issuer Identification Number (IIN). Among these 6 or 8 digits, the first digit specifies the industry that issued the card.

For instance, 1 and 2 signify the airline industry, 3 denotes travel or entertainment, 4 or 5 indicates banking, 6 stands for banking or merchandising, 7 for petroleum, 8 for healthcare and communication, and 9 for national government purposes.

After that, the next 5 digits denote the card’s network, such as whether it’s a RuPay, Visa, or Mastercard. That’s why sometimes when you start typing the digits on an online shopping website, the site automatically recognizes the card type without needing the entire number to be entered.

Next comes the section from 6 to 9 digits, which is the unique account identifier on that network for the cardholder. Depending on the card, this can be a 6 or 9-digit number, usually a 9-digit one.

Finally, there’s the last digit, known as the check digit. It’s matched against an algorithm called the LUHN algorithm, which validates the entire card number.

How LUHN Algorithm Work?

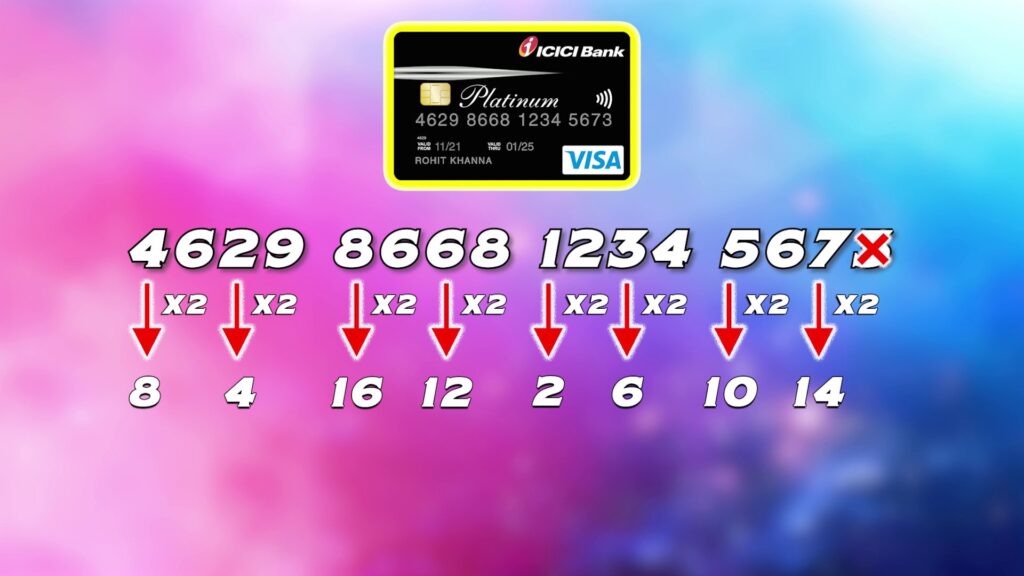

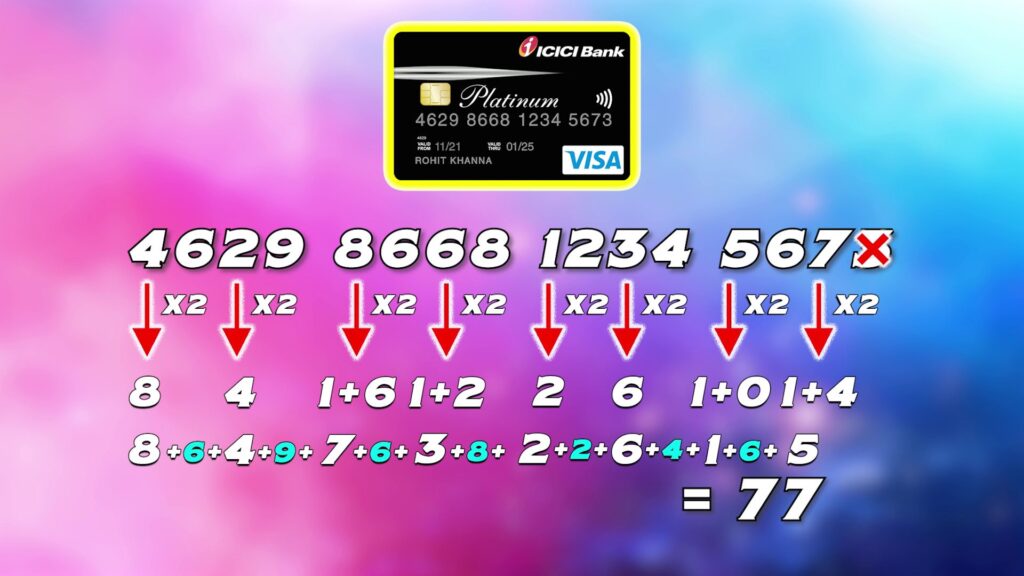

Firstly, remove the check digit and start from the second last digit of the remaining numbers.

Move left and double every second digit.

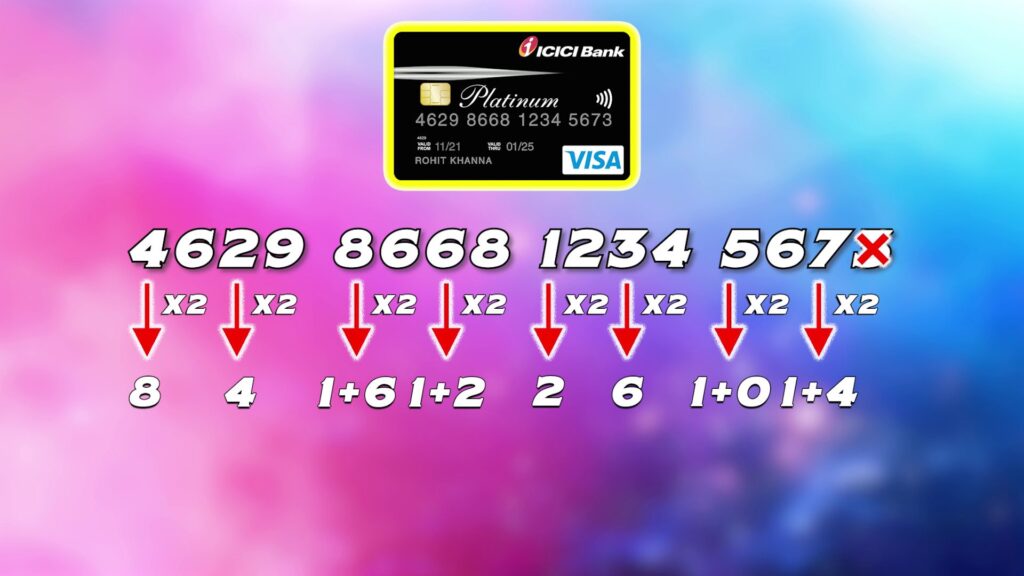

If after doubling, a number becomes greater than or equal to 10, add the digits together.

Now, add up all the numbers that were doubled and add the remaining untouched numbers.

Then, take the last digit of this Addition and Subtract this number from 10, and the result is the check digit. If the last digit after the Addition is 0 then no need to subtract.

What is CVV?

CVV stands for Card Verification Value, As for CVV numbers, websites don’t have the authority to store them obviously for security reasons. CVV numbers are meant for verification during transactions but aren’t supposed to be stored to prevent potential breaches or misuse.

The CVV number, also known as Card Verification Value, is not a random number. There’s an undisclosed algorithm associated with this 3-digit CVV, generated from a combination of the 16-digit card number and a unique code known only to the card issuer. Each card issuer like Visa, Mastercard, American Express, etc., has its own unique algorithm for this purpose.

The algorithm and the unique number aren’t disclosed for security reasons. If revealed, it could pose a risk if a website storing card details were hacked because while other card details are usually stored, the CVV isn’t. If a hacker gains access to stored card details due to a breach, without the CVV, it’s more challenging to decode.

CVV numbers are neither stored in the card’s magnetic strip nor in the chip; they’re solely located on the card’s surface for security. Due to these security measures, websites don’t have the authority to store CVV numbers. Customers are required to enter the CVV for every transaction as an additional security step.”

Don’t Do These Mistakes with Credit Card

I have already write an article about the topic but I think it’s crucial to include a little bit more information about the safety of credit card. You can click here to redirect to the detailed article about “Credit Card Mistakes

When it comes to using credit cards, it’s crucial to avoid certain mistakes: If you want to maintain a good credit score, consider paying a small amount before the billing date even if you know you’ll pay the full amount later. This helps improve your credit score.

And yes, don’t forget to pay your credit card bill. You can keep the auto-debit option on if you have sufficient balance in your savings account, you can link your savings account with your card for auto-debit.

However, if there isn’t enough balance in your savings account, it’s better to turn off auto-debit. Always ensure to pay your credit card bill on time, preferably before the due date, to avoid any late fees or penalties.

So these are the few tips you can follow to maintain your credit score and maintain your credit card. There are so many things you have to consider while using credit card I am not going to main send all about that in this article I have already written in article where I have mentioned all of these.

In the Concluding lines…

Now you guys know what the credit card number actually means. Hope you guys have enjoyed this article and learned something new. If so then don’t forget to express your thoughts in the comments below thanks for visiting.