If you’re debating whether to acquire a credit card or not, I’d advise you to consider the advantages it offers. Utilized wisely, credit cards can provide unique benefits that other payment methods may not. Credit card has lots of advantages and benefits which I would say you have to take butt always use your credit card smartly if you spend unconsciously and you haven’t any self-control of spending then you might lose all of your money so be careful. Here I am going to list some advantages that only credit card offers.

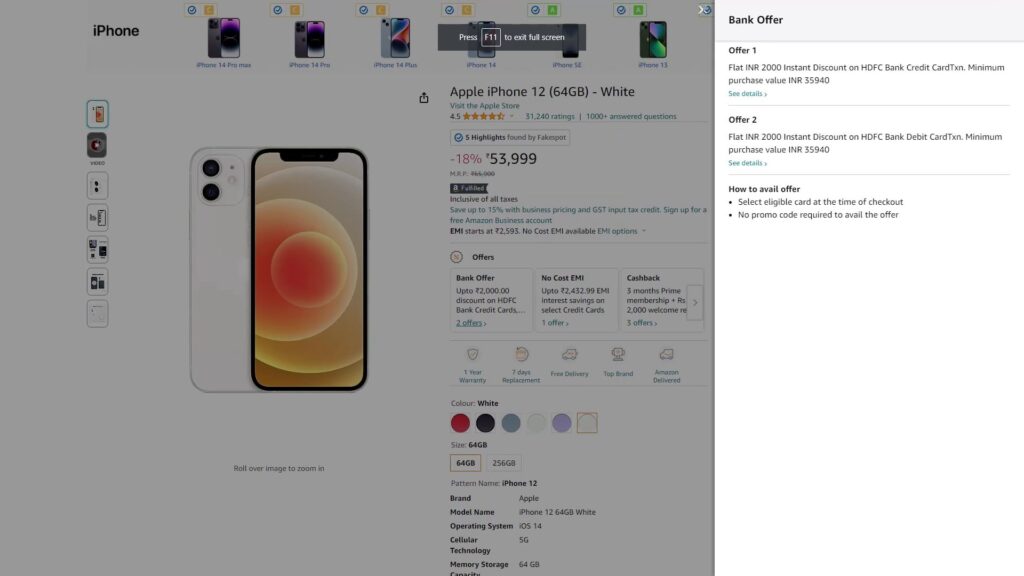

Credit Cards Have Attractive Offers

Credit cards provide enticing offers across various online e-commerce platforms like Amazon, Flipkart, and more. These offers can translate into savings of 7% to 8% or even more, depending on the product. Which is huge. If the price is 25000/- Rs. then you have to pay Rs: 23250/- that’s a large discount. Sometimes because of credit cards, you have some early access to sales and get a large 10% to 15% discount. So that’s a great advantage of having a credit card.

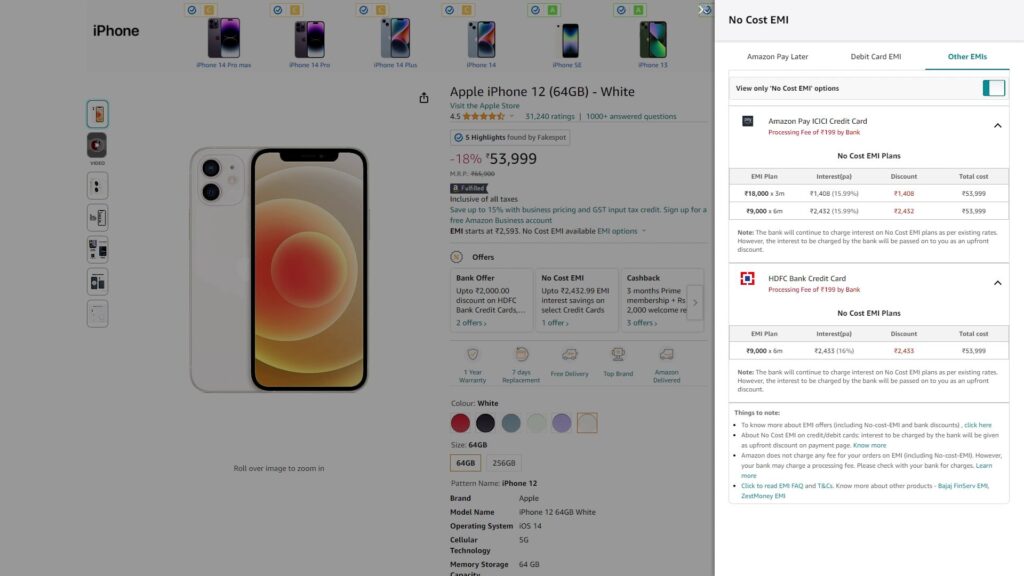

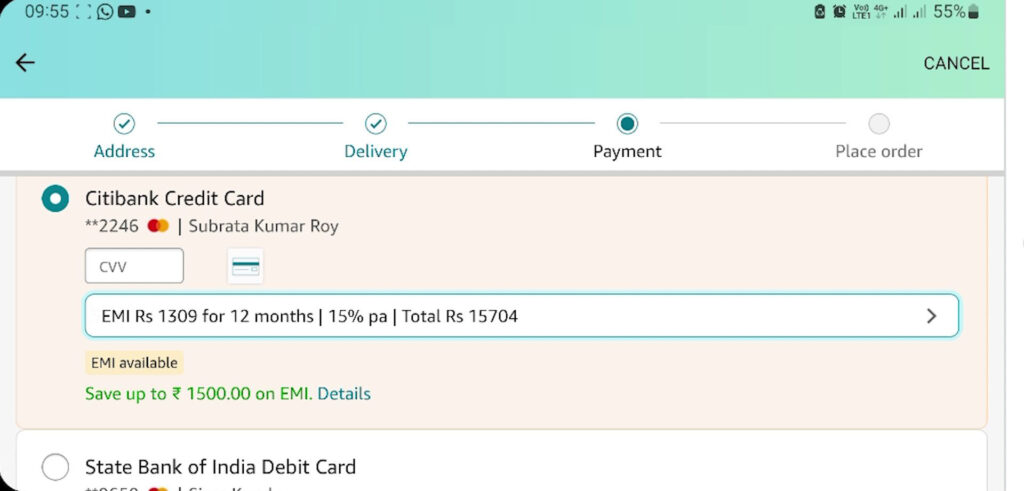

EMI Convenience: Only Credit Cards Offers

If we are following more benefits of credit cards then I would say no-cost EMI is one of the biggest advantages of credit cards. While EMI options aren’t always advantageous, they can only be beneficial if you find a no-cost EMI option. However, it’s crucial to ensure that the product’s price remains unaffected after EMI selection.

Be wary of hidden price hikes. Sometimes there’s no ‘No Cost’ EMI but while you are paying and selecting a specific card for EMI payment the merchant gives you a discount and ultimately after EMI payment that discount will be adjusted as interest of the EMI. So, indirectly it’s a no-cost EMI.

Emergency Support

Credit cards can be a lifeline during emergencies, as they offer up to 45 days of interest-free period. This can be immensely helpful when you need funds urgently but again I would say don’t overspend at the end of the day you are the only one who has to pay the debt. But yes up to 45 days of interest-free period depending upon the credit card is a great advantage of a credit card.

Credit Card: Caution with Cash Withdrawals

One of the biggest disadvantages over benefits is that you should not withdraw cash from credit cards. While credit cards can provide cash in emergencies, don’t do this. If you withdraw cash the interest-free period will not work you have to pay interest of your cash withdrawals on a daily basis. Which is huge so again I am saying do not withdraw cash from the credit card.

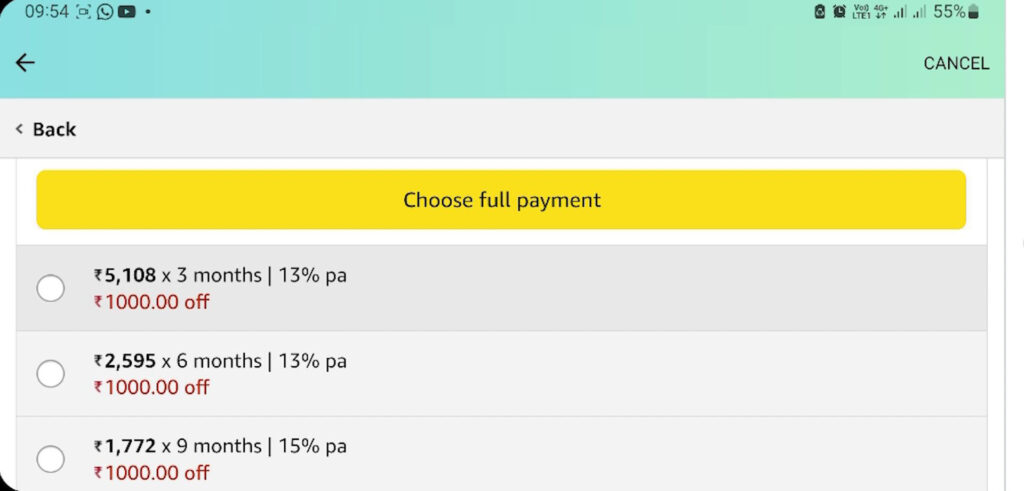

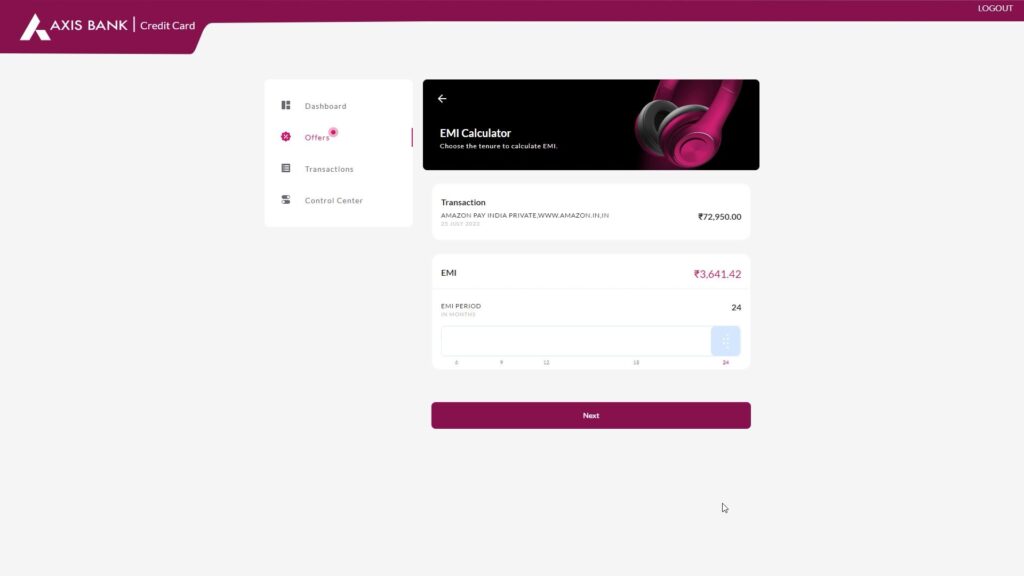

Do Not Convert Your Spend into EMI

In situations where you’ve made substantial expenditures, credit card companies or banks might offer to convert your expenses into EMIs. Be cautious of this option, as it could incur high interest charges, ranging from 15% to 40% annually which is huge. So, I would suggest don’t overspend if for some reason it happens try to pay the full amount in the next month at any cost. If you convert your spending into EMI then you will not get any benefits or advantages from a credit card, instead, you lose money with a credit card.

Do Not Take High Limit Credit Card

As I have mentioned, to get the perfect advantage from a credit card, It’s crucial to avoid overspending on your credit card beyond your means. Opting for a high credit limit may lead to impulsive purchases and debt accumulation. Instead, maintain a credit limit that aligns with your financial capabilities so that you can take benefits from your credit card.

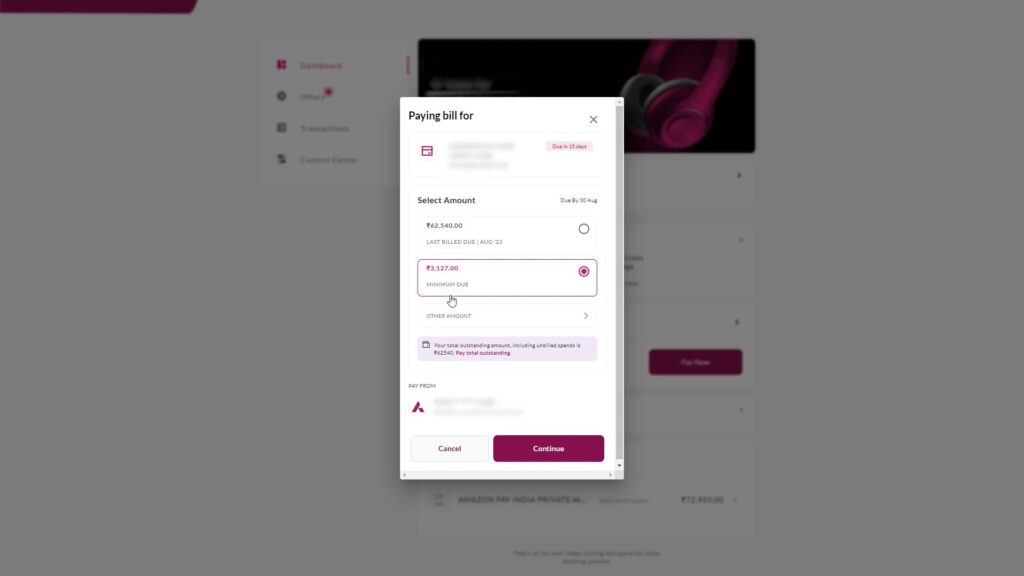

Avoid Minimum Payments

Paying only the minimum amount due on your credit card bills can result in hefty interest charges, often ranging from 30% to 36% annually. To prevent these interest burdens, strive to pay off your entire credit card balance each month. 30% is a huge amount, of course that amount is not valid for each and every card but still, it is at least 15% which is not ignorable, so to take benefits from you’re your credit card never ever just pay the minimum amount of you’re your credit card bill and delay the rest of the spend amount for next month.

Timely and Full Payments

Paying your credit card bills in full and on time is essential. This practice not only prevents interest charges but also helps build a positive credit history, which is vital for future financial opportunities. That takes me to the next benefit of the credit card: building a credit score.

Building Credit Score

If you just joined a job then I would recommend taking a credit card to build your credit score. Responsible credit card usage helps build a positive credit score, which is crucial for future financial endeavors. A good credit score opens doors to favorable interest rates and loan opportunities. With a strong credit score, you gain negotiation leverage when dealing with banks. You can secure better loan terms and access a range of offers tailored to your creditworthiness. Maintaining a solid credit score increases your chances of obtaining loans with favorable terms. This includes lower interest rates and a higher likelihood of loan approval. However, it’s important to note that if your credit score drops due to any reason, you might be offered bank loans with high-interest rates, or in many cases, the bank might even decline loan applications, creating difficulties in loan approval and it takes time to build up the credit score once aga in.

N.B. Utilizing only a portion (around 30% to 35%) of your credit card limit showcases responsible financial management and positively influences your credit score.

Strategic Billing Date Usage

For your convenience and avoid hassles I would recommend you to avoid making online purchases close to your billing date, as this can lead to complications, especially if you anticipate returning the product. For example, if your billing date is 10 of every month, don’t spend anything after the date 1 because if you return that purchased product and in this time period there are any holidays the amount you have taken from the credit card may get credited after the billing date which leads to many problems.

Optimal Usage and Security Measures

When not actively using your credit card, consider temporarily disabling it for online shopping through your bank’s app or website. Alternatively, if you choose to keep it active, set a lower credit limit to minimize potential risks. For example, if your credit limit is Rs 50000/- then set it to Rs 5000/- from the bank’s app or website. One of the biggest benefits of credit cards is that Credit cards offer numerous advantages compared to debit cards in against fraud, such as fraud protection and zero liability policies. In the event of unauthorized transactions, the bank takes responsibility for recovering the funds, ensuring your financial security. So if anything happens wrong with you and you have informed the bank in up to 10 days it’s completely the bank’s responsibility to recover the money you don’t need to pay anything. With debit cards, it’s very hard to recover the fraud. So, it’s the biggest advantage of a credit card.

Caution with Reward Points

While credit cards offer reward points for spending, it’s important not to fall into the trap of overspending for the sake of accumulating points. Prioritize responsible spending over rewards. Depending on the credit card you choose, there are often additional perks and benefits that cater to your lifestyle. These advantages can include complimentary lounge access to domestic and international flights, free subscriptions to OTT platforms, worldwide access to golf courses, and much more. However, it’s crucial to select a credit card that aligns with your lifestyle before applying, otherwise, you have to pay high annual maintenance charges and joining fees.

Many banks offer credit cards that come with these benefits without imposing annual fees or joining fees. Then you can take any card that bank offers you free of cost.

In the Concluding Lines…

In conclusion, credit cards offer several benefits that can enhance your financial flexibility and provide a safety net during emergencies. However, it’s crucial to use them judiciously and within your means to avoid unnecessary debt. Choose a credit card with a reasonable limit and stay vigilant about hidden costs. Remember, responsible usage is the key to harnessing the advantages of credit cards effectively.