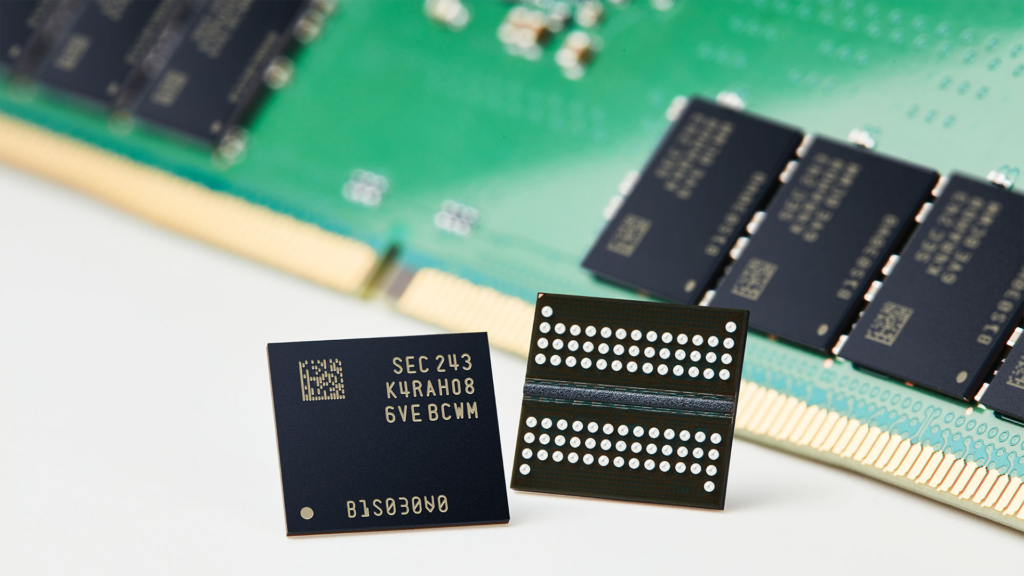

Samsung’s shocking 100%+ price hike on DDR5 memory signals tough times ahead for PC builders, laptop buyers, and smartphone users. Contract prices for DDR5 chips have nearly doubled to $20 per unit, with DDR4 following close behind at $18, due to critical supply shortages and booming AI demand. This escalation, confirmed by industry reports and analysts like Jukan, means consumers face higher device prices through 2026.

The Scale of Samsung’s DRAM Price Surge

Samsung notified downstream clients of a severe DDR5 shortage, declaring “no inventory” available, which triggered contract prices jumping over 100% to nearly $20 per unit. Taiwanese media and leaker Jukan on X report DDR5 contract pricing hit $19.50 for 16GB modules (per 2GB chip), more than double late November levels. DDR4 contracts rose to around $18, eliminating it as a budget fallback for manufacturers.

This marks Samsung’s second major hike in months—earlier increases reached 60% on some products since September. Spot market prices climbed even faster in December, showing no signs of easing. TrendForce warns of further sharp rises in Q1 2026, as memory now forms a larger share of device production costs that OEMs cannot fully absorb.

Root Causes: AI Boom and Production Shifts

Memory giants like Samsung prioritize high-margin products amid exploding AI data center demand. Nvidia H100-style servers devour high-end DDR5 and HBM, starving consumer supply chains. Manufacturers cut DDR4 output to ramp up DDR5 and advanced DRAM, creating artificial scarcity.

Panic buying by distributors worsened the crunch, with reports of Samsung employees allegedly accepting bribes from desperate customers during the surge. Reddit discussions highlight how AI’s sudden 2025 takeoff caught fabs off-guard, hitting memory first before GPUs or other components.

Direct Impact on Smartphones: Specs Downgrades Ahead

Smartphone makers face the sharpest pain. TrendForce predicts a return to 4GB RAM base models by 2026 to cut costs—reversing years of 8GB+ standards in mid-range devices. Premium phones may tighten to 12GB instead of 16GB, delaying upgrades and hurting perceived value.

Also Read: Best Phone Charger 2026: Ultimate Buying Guide

Android brands, reliant on RAM specs for marketing, could hike launch prices or revive microSD slots for expandable storage. Apple faces rising iPhone BOM costs, potentially rethinking price cuts on older models despite strong margins.

Laptops and PCs: Price Hikes Locked In

Dell leads commercial PC price increases of 10-30% starting December 17, citing memory costs. Consumer notebooks hold steady short-term via inventory, but ultra-thin soldered-RAM models have no escape—expect hikes by Q2 2026 around Computex.

Gaming PC builders see DDR5 kits (already premium) balloon further, while DDR4’s “value” edge evaporates. Custom rigs with RTX 4060+ could rise 10-20k INR total, pushing many toward used/refurb DDR4 platforms like Ryzen 5600.

| Device Category | Short-Term Effect | 2026 Outlook |

| Smartphones | Tighter RAM configs (6-8GB mid-range) | 4GB base models return; prices up 5-10% |

| Commercial PCs | Dell +10-30% now | Full pass-through to consumers |

| Gaming Laptops | Inventory buffer | +15% on DDR5 models post-Computex |

| Custom Builds | DDR4 still viable | DDR5 kits +20-30% |

Broader Industry Ripple Effects

OEMs scramble: Notebook lines get revised, procurement shifts to spot markets at even higher premiums. Server builders accept shortages, paying “extreme” markups. Sapphire’s PR manager offers faint hope of cooling in six months, but most analysts see elevated prices persisting beyond 2026.

India feels amplified pain via import duties—Flipkart/Amazon RAM already up 50-80%. Budget gamers pivot to GPU/SSD upgrades over platforms, echoing advice from recent XDA analyses on viable older CPUs.

What Buyers Should Do Now

Immediate Purchases: Lock in DDR4 systems (Ryzen 5 5600 + B550, i5-12400F) with 32GB 3200MHz—still relatively affordable. Prioritize 8GB+ RAM phones before specs shrink.

Wait-and-See: Delay new DDR5 builds until Q3 2026 for potential stabilization. Monitor used markets for Ryzen 5000/Intel 12th-gen deals.

Long-Term: Expect a hardware cycle of higher prices but slimmer specs. Smart builders focus value over “latest”—a good GPU trumps marginal CPU/RAM gains in most 1440p scenarios.

Samsung’s hike underscores memory’s new centrality in AI-driven economics. Consumers brace for a pricier 2026, but strategic timing saves thousands. Stay updated as Q1 unfolds.