The due date for Income Tax Return (ITR) filing for the Assessment Year (AY) 2025-26, originally set for 31st July 2025, has been officially extended to 15th September 2025 by the Central Board of Direct Taxes (CBDT). This extension applies primarily to individual taxpayers, Hindu Undivided Families (HUFs), and others who are not required to get their accounts audited. The extension was granted considering multiple factors like significant changes in ITR forms, the time needed for system readiness, and delayed availability of Tax Deducted at Source (TDS) data.

If taxpayers miss this extended deadline, they still have the option to file a belated return up to 31st December 2025, but late fees and interest charges will apply. For taxpayers who are required to have their accounts audited, the original deadline remains 31st October 2025. There are also specific deadlines for those involved in international or specified domestic transactions, which remain 30th November 2025.

In addition to the deadline extension, several professional bodies have requested further extensions due to ongoing technical issues like portal glitches, data mismatches, session timeouts, and other difficulties faced during the filing process. However, as of now, no further official extensions have been confirmed beyond 15th September 2025.

If filing is delayed beyond the deadline, late fees under Section 234F (up to Rs 5,000 or Rs 1,000 for incomes below Rs 5 lakh) and interest under Section 234A (1% per month on tax due) will be imposed. Thus, filing on or before the extended date is strongly recommended to avoid penalties and interest.

I will prepare a detailed 1500-word blog in English covering the ITR filing due date extension for AY 2025-26, its reasons, implications, penalties for delay, advice for taxpayers, and the context around system challenges and further extension requests.

Income Tax Return (ITR) Filing Due Date Extension for AY 2025-26: What Taxpayers Need to Know

The Central Board of Direct Taxes (CBDT) has officially extended the due date for filing Income Tax Returns (ITRs) for the Assessment Year (AY) 2025-26. Originally, the filing deadline was set for 31st July 2025, but it has now been extended to 15th September 2025 for individual taxpayers, Hindu Undivided Families (HUFs), and entities not required to undergo account audits. This important update came in response to several factors shaping the filing season, aiming to ease compliance and ensure accuracy.

This blog provides a comprehensive overview of the ITR filing due date extension for AY 2025-26, its underlying reasons, deadlines for different categories of taxpayers, consequences of missing deadlines, and current developments in the tax filing landscape.

Background and Announcement of the Extension

In May 2025, the CBDT, exercising its powers under Section 119 of the Income-tax Act, issued a notification to extend the filing deadline for certain taxpayers from 31st July 2025 to 15th September 2025. This decision was influenced by:

- Substantial structural and content revisions in the notified ITR forms for AY 2025-26 aimed at simplifying compliance and increasing reporting accuracy.

- The additional time required for developing, testing, and rolling out new return filing utilities on the income tax portal.

- Delays in the availability of Tax Deducted at Source (TDS) credit statements which taxpayers rely on when preparing their returns. Typically, TDS details from employers and deductors are furnished by the end of May, but reflecting them accurately in the system took longer.

- Feedback from taxpayers and professionals requesting additional time due to the changes and to avoid errors or incomplete reporting.

Through this extension, the CBDT sought to provide a smoother, more convenient tax filing experience and avoid last-minute rushes that often lead to mistakes or system glitches. This also aligns with the government’s broader agenda of enhancing transparency and taxpayer convenience through digital reforms.

New Deadlines for AY 2025-26 Filing

Different categories of taxpayers have distinct filing deadlines. Here is a summary of the key due dates post-extension:

| Category of Taxpayer | Due Date for ITR Filing for AY 2025-26 |

| Individuals / HUF / Association of Persons (AOP) / Body of Individuals (BOI) (Non-audit cases) | 15th September 2025 |

| Businesses requiring audit | 31st October 2025 |

| Businesses requiring transfer pricing reports (International/Specified Domestic Transactions) | 30th November 2025 |

| Filing of Revised Returns | 31st December 2025 |

| Filing Belated Returns (late submissions) | 31st December 2025 |

| Filing Updated Returns (4 years from end of assessment year) | 31st March 2030 |

While the deadline extension to 15th September applies to those not subject to audit requirements, taxpayers who are mandated to get their accounts audited must adhere to the earlier deadline of 31st October 2025. Taxpayers involved in international or specified domestic transactions must file by 30th November 2025.

What Happens If You Miss the Deadline?

Filing ITR beyond the due date results in both financial and legal consequences. The key impacts of late filing for AY 2025-26 are:

- Late Filing Fees (Section 234F): Taxpayers who fail to file their returns within the due date will be liable to pay a late fee of up to Rs 5,000. However, if the total income is below Rs 5 lakh, the late fee is reduced to Rs 1,000.

- Interest on Outstanding Tax (Section 234A): Interest is charged at the rate of 1% per month or part of the month on any unpaid tax from the original due date till the date of filing.

- Loss of Carry Forward Benefits: Losses under various heads such as capital losses or business losses cannot be carried forward if the return is not filed within the due date.

- Reduced Time for Filing Revised Returns: The window to file revised returns is limited to before the completion of assessment or 31st December 2025, whichever is earlier, restricting taxpayers’ scope to rectify errors.

Despite these penalties, taxpayers still have the opportunity to file belated returns up to 31st December 2025 with applicable fees and interest, allowing some form of compliance relief.

Also Read: Six Best SBI Credit Cards: Features, Eligibility, and How To Apply

Reasons Behind the Extension

Several compelling reasons contributed to the extension of the filing deadline:

1. Significant Changes in ITR Forms

The Income Tax Department introduced changes to the structure and content of ITR forms for AY 2025-26, aimed at simplifying the filing process and ensuring more accurate tax reporting. These changes included improved schedules and annexures, adjusted reporting requirements for new types of income, and better alignment with other tax compliance data.

However, such extensive revisions required meticulous testing and system updates, which prolonged the readiness of the tax portals and utilities.

2. Delays in TDS Data Reflection

Taxpayers often rely on Form 26AS and Annual Information Statement (AIS) data showing their TDS deductions. These data points come from employers and other deductors who file TDS returns, generally by the end of May.

Due to processing delays, these details became available to taxpayers only in early June, reducing the effective time window between data availability and the original July 31 deadline. The extension to September 15 offers more time to verify data accuracy and incorporate it in returns.

3. Feedback from Tax Professionals and Taxpayers

Various stakeholders, including Chartered Accountants and taxpayer associations, had requested a deadline extension. They highlighted operational challenges during the filing season such as:

- Technical glitches and server downtime on the income tax portal.

- Data mismatches between AIS and Form 26AS.

- Session timeouts and portal slowness.

- Increased complexity due to new reporting mandates and form structures.

These practical difficulties justified the government’s decision to extend the deadline to facilitate a smoother compliance process.

Current Scenario and Further Extensions

As of early September 2025, the extended due date of 15th September is approaching. Some professional bodies like the Chandigarh Chartered Taxation Association (CCATAX) have requested additional extensions citing ongoing technical issues.

It is important to note that while the government has been open to granting relief extensions in some past years, as of now, no official announcement has been made for further deadline relaxation beyond September 15 for non-audit cases.

Taxpayers are thus advised to use the remaining time optimally to complete accurate filing and avoid the risk of penalties.

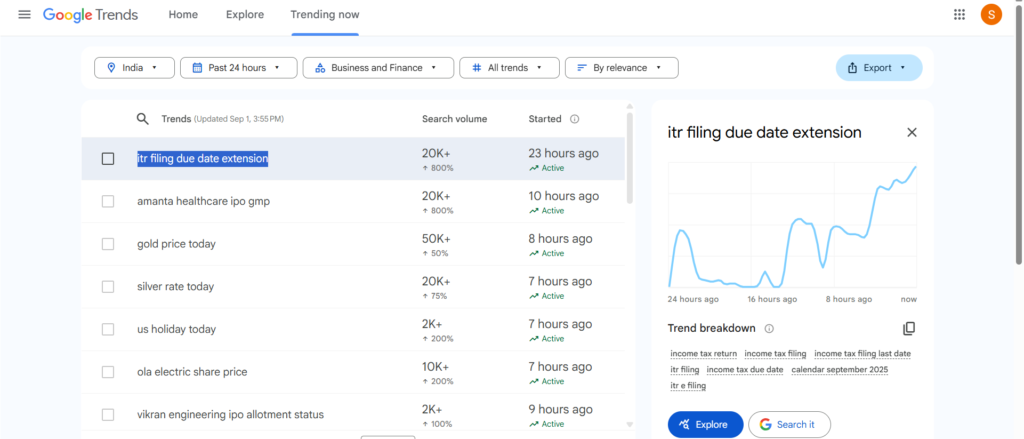

The rise of the keyword ‘ITR due date extension’ on Google Search Trends

Tips for Taxpayers Filing for AY 2025-26

To leverage the deadline extension effectively and avoid last-minute hassles, taxpayers should consider the following:

- Start Early: Even with the extension, begin the filing process early to have enough time to gather documents, cross-check TDS and AIS data, and resolve discrepancies.

- Verify TDS and AIS Data: Ensure the Tax Deducted at Source details in Form 26AS align with actual income and deductions claimed. Report any mismatches to deductors promptly.

- Use Correct ITR Form: Due to changes, confirm that you are using the notified ITR form relevant to your income source and category to avoid rejections or notices.

- Keep Documents Ready: Maintain all necessary proofs like salary slips, rent receipts, investment proofs, bank statements, and audit reports (if applicable).

- Consult Professionals if Needed: For complex tax situations or businesses requiring audits, seek professional assistance to ensure accuracy.

- File Before Deadline: Don’t wait until the last moment, as portal traffic spikes can cause delays and errors.

- Avoid Penalties: File before 15th September if not audit cases, or by respective dates for audit cases, to avoid interest and fees.

- Rectify Errors Promptly: File revised returns within stipulated timelines if you identify errors or miss claims after filing.

Conclusion

The extension of the ITR filing due date to 15th September 2025 for AY 2025-26 reflects the government’s sensitivity to taxpayers’ needs amidst evolving compliance requirements and technical challenges. While this additional time is helpful, taxpayers are encouraged to prioritize timely and accurate filing to benefit fully and avoid penalties or complications.

With changing tax laws and digitalization, staying informed and prepared is key to smooth tax compliance. Utilize the extended deadline wisely, check all details thoroughly, and consult experts where needed to ensure stress-free filing this year.

By adhering to deadlines and maintaining precise records, taxpayers contribute to a transparent, efficient tax ecosystem that benefits both the government and the citizens.